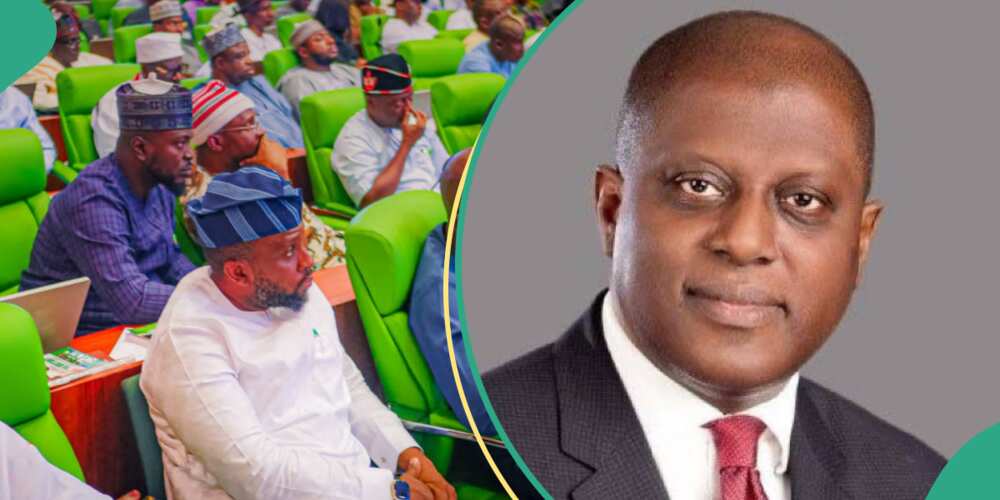

FCMB Group Records 186% Profit Growth, Proposes 50k Dividend 2024 the news is now available about how FCMB Group Records 186% Profit Growth, Proposes 50k Dividend 2024 – african2nice Business news.

FCMB Group Plc grew deposits, loans, assets under management, revenue and earnings and improved its environmental, social, and corporate governance scorecard. The Group recorded a profit before tax of ₦104.4 billion, a 186% year-on-year (YoY) increase compared to ₦36.6 billion in 2022 and earnings growth across its business segments: Banking Group 212.6%, Consumer Finance 67.3%, Investment Management 40%, and Investment Banking 89.7%.

FCMB Group, which proposed a dividend of 50 kobo per share for its shareholders, contributed to food security and import substitution in Nigeria by increasing lending to the agricultural sector by 38.4% from N147.4 billion in 2022 to N204.3 billion in 2023.

In addition, the Bank supported over 300,000 smallholder farmers, 56% of whom were women in agriculture, in rural communities to support the sector. Over $280 million of funding from DFI’s and donor agencies was raised during the year to support the attainment of sustainable development goals in critical sectors of the economy.

Leveraging its core banking business, the Group facilitated over $700 million and $100 million in export and remittance flows into Nigeria, respectively, as at December 2023.

In safeguarding the environment, it switched six additional branches of its retail and commercial banking subsidiary (First City Monument Bank Limited) from grid/diesel generators to solar power last year, taking the number of branches running on renewable energy to 160, which represents 78% of total branches.

In addition, the Bank secured funding of up to N13 billion from local development finance institutions for on-lending to customers requiring solar energy solutions to further support its commitment to driving renewable energy.

FCMB Group Records

FCMB’s customer base grew by 15.6% YoY from 10.9 million to 12.5 million for the period ended December 2023, whilst users of its mobile app that offers lending, wealth and payment solutions grew by 31% YoY to 3.4 million. Similarly, the Bank’s agency banking network grew to over 164,000 agents. With an enlarged customer base, an expanded distribution platform, and the use of artificial intelligence to automate and optimise loan underwriting processes, the Group successfully disbursed over 1.5 million loans worth N100.8 billion to individuals, N14.4 billion to micro-enterprises and N177.9 billion to SMEs during the period.

Commenting on the results, the Group Chief Executive of FCMB Group Plc, Mr Ladi Balogun, said:

“We continue to leverage our unique Group structure to build a technology-driven ecosystem that is fostering inclusive and sustainable growth in the communities we serve. This strategy is enabling us to deliver robust performance in spite of the challenging domestic and global environment.

Barring unforeseen circumstances, we believe this trend will be sustained and accompanied by improving efficiencies arising from greater scale and ongoing digitisation”.

The results across market fundamentals also showed gross revenue of N516.4 billion for the period ended December 2023, an 82.5% growth from N283 billion for the same period the prior year. Net interest income grew by 44.8% from N122 billion in 2022 to N176.6 billion in 2023.

Customer confidence in FCMB remained strong, as deposits rose by 58.5% YoY from N1.94 trillion to N3.08 trillion, just as loans and advances grew by 54% from N1.20 trillion to N1.84 trillion.

The Group’s total assets increased by 48.3% from N2.98 trillion to N4.42 trillion at the end of December 2023.

FCMB Group’s Assets Under Management increased by 29.6% last year from N783.7 billion to N1.02 trillion.

The value of investment banking transactions consummated by the Group rose to N945.3 billion for the period ended December 2023, compared to N857.1 billion in the same period the prior year.

FCMB Group, a financial services holding company headquartered in Lagos, Nigeria, and listed on the Nigerian Exchange Group (NGX), has strategic interests in companies serving over 12.5 million customers across five key platforms: banking, consumer finance, investment management, investment banking, and financial technology.

The Group and its subsidiaries are building an ecosystem that promotes inclusive and sustainable growth in their communities, primarily in Africa, its diaspora, and the United Kingdom, by connecting people, capital, and markets.

Discover more from African2nice Television

Subscribe to get the latest posts sent to your email.

Leave a Reply