Below comes the Best Digital Banking Platforms In Nigeria 2024 as research by african2nice may have it about Best Digital Banking Platforms In Nigeria 2024 – Banking news updates 2024.

Top 10 Best Digital Banking Platforms In Nigeria (2024)

As digital banks continue to disrupt the traditional Nigerian banking system, many Nigerians are looking to transition to the digital banking system. They typically offer more reliable service and lower service charges. But with so many digital banks available, you may be wondering which of the platforms would be best for you. We have compiled a list of the 10 best digital banking platforms in Nigeria based on their effective performance.

1. PSTNET

PSTNET offers virtual dollar cards for purchasing goods and services worldwide, as well as for advertising accounts. Visa/Mastercard cards in dollars and euros are available. Fast registration is possible using a Google account, Telegram, email and password, WhatsApp, or an Apple account. The first card can be obtained without documents (with a limit of up to $500, simple verification is required to increase the card issuance and spending limits).

Using PSTNET virtual cards, you can make purchases and pay for services worldwide. Now platforms such as Aliexpress, eBay, Steam, Spotify, Netflix, Facebook, and Amazon, as well as online stores including Google Store, Apple Store, Galaxy Store, Microsoft Store, PlayStation Store, and Epic Games Store, will become accessible thanks to PSTNET virtual cards. Easy top-up methods include cryptocurrency (+15 coins), credit cards, or transfers. Some cards support 3DS Secure, and all cards are reloadable.

Users can also choose a suitable temporary plan: pay $7 every week or pay for a year upfront. Currently, there is a 48% discount, so the annual plan will cost $99.

The service has earned significant trust among users, as evidenced by numerous positive reviews about PSTNET.

2. Opay

Opay takes number one among the best banking digital platforms in Nigeria. The 2018-founded Fintech company captured the hearts of numerous Nigerians during the cash scarcity period, as many testified to their reliable, fast, and seamless transactional services.

The company has reportedly garnered over 30 million users, most of whom signed during the torturous cash scarcity period. It is imperative to note that the platform is fully licensed by the Central Bank of Nigeria (CBN) with all deposits insured by the National Deposits Insurance Corporation (NDIC).

3. Kuda Bank

\

Kuda has been catching the interest of many Nigerians in the last few years. Aside from being one of the few licensed digital banks that offer free full-service banking services to Africans. It is also one of the top FinTech companies in Nigeria with a valuation of $500 Million.

This digital Bank eliminates the typical paper process as everything is carried out online. This digital-only bank enables users to open accounts online within minutes and gives 25 free transactions per month. it also offers customized Mastercard ATM cards with no transfer fees or ATM maintenance fees

4. Moniepoint

Although relatively new, Moniepoint is one of the digital platforms that rescued Nigerians from the ridiculous services rendered by traditional banks during the cash scarcity. The platform formerly known as TeamApt is a CBN-licensed microfinance bank delivering financial services digitally.

The company last year secured a Switch and Processor license from the CBN in addition to its Microfinance license, providing over 600,000 businesses with banking, payments processing, and business management tools. Moniepoint was awarded by the CBN in 2022 as the most inclusive payment platform in the country.

5. VFD

Like Kuda VFD has been in the face of Nigerians for a few years. It, however, proved its worth in the face of the financial crisis that bewildered the nation earlier this year. The platform is a streamlined digital and mobile banking platform offering individuals and businesses swift, secure, and cutting-edge banking services.

Aside from having Don Jazzy as its brand ambassador, the bank also offers a wide range of products like fixed savings, instant loans to cardless withdrawals. Vbank has zero charges on transactions and account maintenance and offers its customers a monthly interest on savings.

6. ALAT

I don’t use Wema Bank, but as one of the traditional banking institutions in the country, their services are most likely shitty. However the company’s digital platform, ALAT is said to be one of the best digital banking platforms in Nigeria, Of course, the 2nd greatest G.O.A.T of Afrobeat, Davido is part of the team.

According to a report, the platform is Nigeria’s first fully digital bank (whatever that means). the bank, however, offers a smooth banking experience, offering numerous services Like bill payments, fund transfers, investments, credit and debit cards, loans, and many more.

7. Chipper Cash

Chipper Cash takes sixth place among the best digital banking platforms in Nigeria. The venture-capital-backed Financial technology company enables free and instant Peer-to-peer Cross-border payments in Africa and Europe. They also have Burna Boy on their team. I don’t really understand the obsession with Afrobeat these days.

The platform was founded in 2017 by Ham Serunjogi and Maijid Moujaled and it is headquartered in San Francisco, California. It also offers other services like discounted airtime purchases, data bundle purchases, zero charges on bill payments, virtual Cards, and U.S. Stockstock tradingOne Bank

Sterling Bank may not offer the best of traditional banking services. However, the Company’s digital platform, One Bank is said ( I didn’t say so) to be one of the best digital banking platforms in Nigeria.

According to the website, the platform offers all the needed banking services a customer can get, removing the need for a conventional bank experience. But seriously I don’t why a bank with an always empty banking hall even on Monday Morning will offer services that allow customers to sit in their homes. You don’t need it bruh.

8. Mint

Mint is one of the newest kids on the block but is no doubt one of the best digital banking platforms in Nigeria. The Mint account is provided by Finex Microfinance Bank Ltd, which is licensed by CBN. This bank offers a wide range of products from current and savings accounts to low-interest loans, and a personalized money tracker.

The bank also charges no fees for maintenance or transactions when operating a current account, and the savings accounts offer goal-based savings plans that can reward customers with up to 36.5% interest. With the round-up option, Mint will round up cash from your transactions to the nearest hundred or thousand, transfer them to your savings, and earn you up to 15% interest.

9. Sparkle

Sparkle was launched in 2019 by the former Chief Executive Officer (CEO) of the defunct Diamond Bank, Uzoma Dozie. The MF failed at traditional banking and decided to go digital. Anyways the bank offers its customers both personal and business accounts. Since its launch, the bank has handled more than $ 16 million in transactions, has over 400 million naira in deposits, and has over 20,000 customers.

The platform also has virtual and physical cards and also a saving plan that allows you to earn 3.75% per annum interest rates if you have a minimum amount of ₦100,000 in your Sparkle stash. With SparklePay, customers can send and receive payments with the use of a uniquely generated payment link.

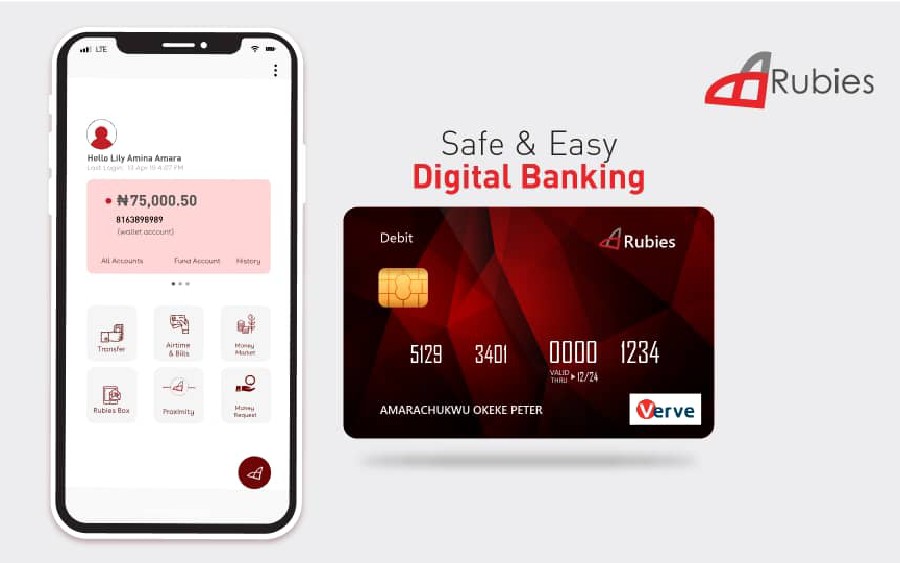

10 Rubies

Rubies concludes the list of the best digital banking platforms in Nigeria. The platform offers zero-fee banking targeting businesses, millennials, young professionals, SMEs, Fintech companies, and financial institutions. It also has a well-functioning mobile app for iOS and Android that customers can access all banking services.

Other notable feature includes the money request feature, numerous flexible saving plans, and the free Rubies debit Naira card for payments and ATM transactions. You can additionally request a virtual dollar card to use for online transactions and payments.

Discover more from African2nice Television

Subscribe to get the latest posts sent to your email.

Leave a Reply